Disputing Credit Card Transactions

Disputing A Credit Card Charge

Have you ever received a credit card statement and didn't recognize a charge on it? If so, you're one of thousands of people this happens to each month. Every month, thousands of unauthorized, as well as authorized, charges are disputed by credit card consumers. The following is information that will help you navigate the dispute process and recoup money that was charged to your account erroneously.

Reconcile Your Credit Card Statements Each Month

Begin the Dispute Process

It is important to review your credit card statement each month so that you know what was charged to your card. This is especially true if you intent to dispute one of those charges. Visa and Mastercard have specific criteria that must be followed by the issuing bank, and in many cases, a disputed charge must be reported within 30 days of the charge posting to the account.

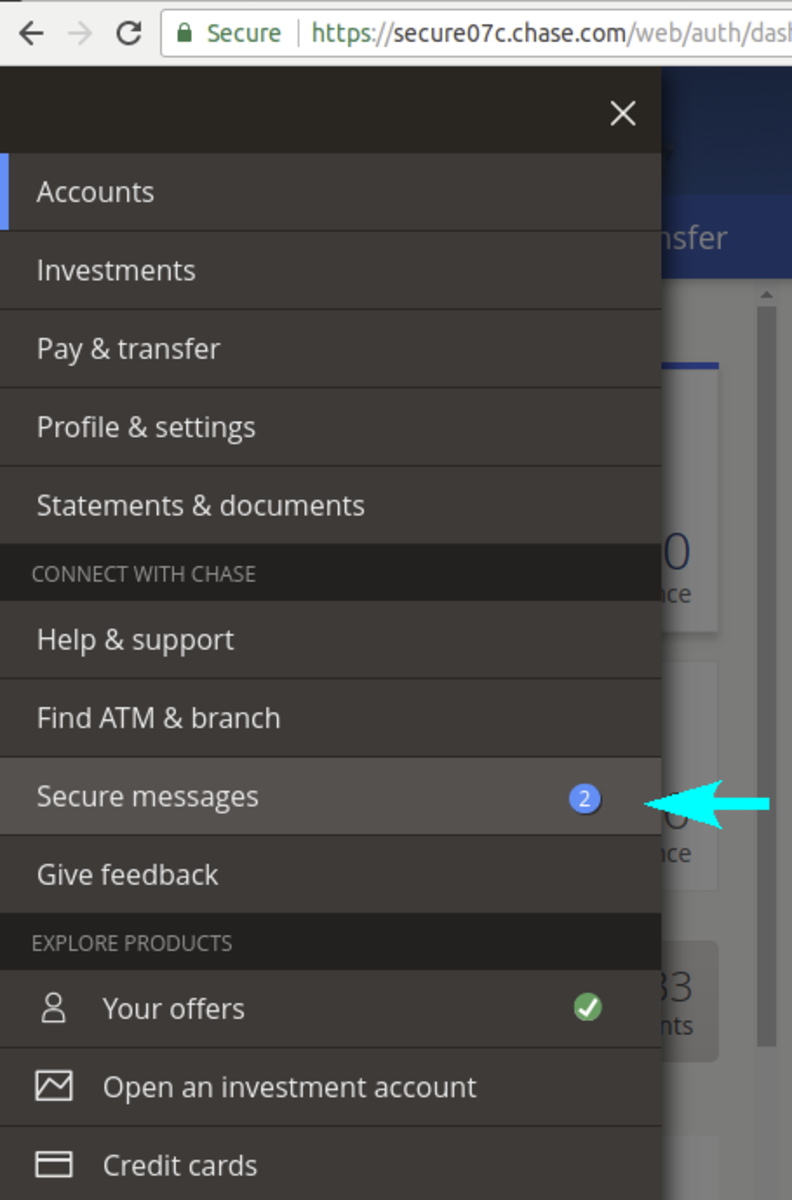

How do you start the dispute process? Check your account statement and call the customer service number. In many cases your bank will have special representatives to handle credit card disputes.

You should have the following information handy before you make the call:

- The date the transaction posted to your account

- Was the charge authorized (such as a recurring charge to Netflix that you have recently canceled)

- If the charge was authorized originally , but you canceled it, you'll need to provide the date of cancellation

- Was the charge unauthorized (you NEVER interacted with the merchant, EVER)

- The amount of the charge

Customers should also be aware that they should have tried to resolve the dispute with the merchant prior to initiating a dispute through the credit card company. This information is provided on the credit card statement.

What to Expect

After you initiate a dispute, you should receive a form in the mail that needs to be signed and dated. This form should then be returned promptly. In the event that the merchant disputes your claim, your signed form will help to support your claim against them. The bank that issued your credit card is required to have this signed form in their possession in order to proceed with your claim, should it continue.

The bank that issued your credit card will place a temporary credit on your account for the disputed charge. This credit will become permanent once the dispute is settled.

Make sure that you respond to any requests for additional information, even if it seems like you already answered those questions before. Signed and dated documents, affirming your claim, may be required if the dispute continues. While it may seem like a good idea to yell at a customer service representative because they've asked you to sign another form, Visa and MasterCard require this from the bank.

What you should know: initiating a dispute on behalf of a customer through Visa and MasterCard costs your bank $75 or more, just to file your claim. These claims are not overseen by your bank, but by the entities of Visa and MasterCard. Your bank has to follow the rules set forth by these governing bodies regarding any dispute.

Make Payments During the Dispute! Credit card account holders must continue to pay their accounts on time, even during a dispute. Refusing to pay your account will only hurt your credit rating. The only exception is if the entire balance on the account is a result of the disputed transaction. You are still responsible to pay for the remaining balance on your account if there are other transactions not in dispute.

The Dispute Process

There are four possible phases of a credit card charge dispute. They include:

Chargeback - this is when a customer disputes a charge and the merchant is given a chance to respond to the dispute. If the merchant agrees that there was an error, the customer is given a permanent credit on their account and the dispute is ended.

Representment - this happens when the merchant believes that the customer was correctly charged for a transaction. Further information is often required from a customer to proceed with the dispute - timely answering of questions and returning requested forms is necessary in order to resolve the dispute.

Pre-Arbitration - this happens when both the merchant and customer believe that they are correct about the charge. Additional information may be required from both parties to proceed to the final stage of the dispute process.

Arbitration - Visa or MasterCard will review all of the documentation from both parties and render a final decision. The dispute cannot be carried any further by the bank once a final decision has been made. If a card member wishes to continue the dispute (assuming the decision wasn't in their favor), they will have to take the merchant to court themselves.

At this point, a charge may be placed back onto an account, depending upon the individual bank. If a card member isn't charged for the transaction, even if they lost the dispute, it means that the bank took a loss for the card member and paid the merchant out of their own funds.

About Your Bank

It is easy to become upset when a charge that you don't recognize appears on your account statement. However, it is important to remember a few things about credit card transactions in the dispute process:

- The bank (usually) doesn't represent the merchant in a dispute. Rarely, a bank happens to have both a merchant and an individual's account in a dispute. Even if they do, the bank doesn't get to take sides in the dispute. Remember, the bank won't be overseeing the dispute- Visa and Mastercard will.

- Visa and MasterCard, which are separate entities, decide whether a bank can issue a credit card with their logo or not.

- Recurring charges may continue to post to your account- each of these charges should be disputed, if they are unauthorized, and reported to your bank's customer service department.

- Don't assume that your account will be reviewed each month for additional erroneous charges. It is your responsibility to review your account statement each month for unauthorized charges.

- Individuals don't review each charge that occurs on credit card accounts. Charges are processed electronically- if you have available credit, a charge can occur, authorized or not, if someone has your account number.

What is Visa and MasterCard?

- MasterCard

MasterCard Worldwide manages a family of well-known, widely accepted payment cards brands including MasterCard , Maestro and Cirrus and serves financial institutions, consumers, and businesses in over 210 countries and territories worldwide. - Visa USA | More People Go with Visa

Visa USA has information on Visa credit and debit cards, including Visa Classic, Visa Secured, Visa Gold, Visa Platinum, Visa Signature, and Visa Check cards. Find the Visa card that's right for you.